Preliminary economic crisis package of Turkish government

Turkey’s central bank has sharply increased its inflation forecast on June 31, raising the expectation from 8,4 percent to 13,4 while the implied rate is around 15-20 for the year of 2018. The report of the bank announces the most important basis of the economic crisis management package of Turkish government that is to be released on August 18.

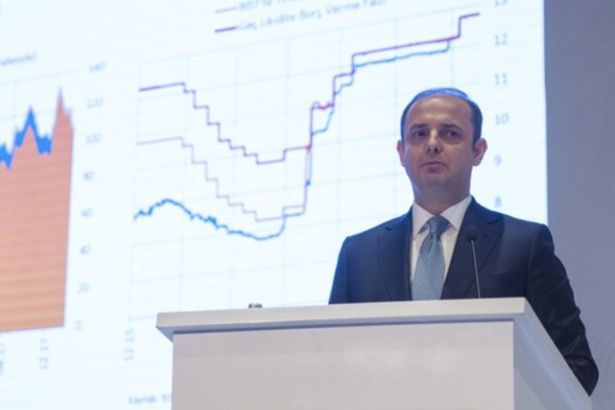

Murat Çetinkaya, the governor of the central bank, has announced the bank’s quarterly inflation report, indicating to cost-based inflation and structural reasons. As part of short-termed “measurements”, he has underlined that the wage rises in the public sector will not be based on the past but on the future goals.

DOUBLE-DIGIT INFLATION FORECASTS

Despite the consumer price index reaching up to 15,4 percent and the producer price index around 23,4 for the first half of 2018, the central bank has announced to raise the wages in 2019 at the rate of 9,3 percent that is the inflation forecast for the next year. The report argues that the rise around 14 percent in minimum wages for the beginning of 2018 was “high”.

“The rate of rise in costs accelerated at the first quarter of 2018. The rise of 14,2 percent in minimum wages for 2018 also led to a growth in other costs,” the report has said, adding that the annual rate of increase in non-agricultural nominal gross wages and wage index was around 20,7 percent while consumer inflation was 10,3. However, the report does not indicate to any data for the second quarter, considering that the real growth in question has already melted.

The central bank’s report implies that the loss in wages for 2018 will not be met in 2019, contrarily, the melt down in real wages will continue throughout the next year. Since the government-controlled costs and wages include the designation of the wages of civil servants and minimum wage employees, the report implies to set the high limit in wage rises for 2019 in accordance with that of the private sector, showing that wages will be around 5 percent despite the inflation rate around 20.

The bank’s report on inflation demonstrates that the inflation forecast for the end of 2018 will exceed 12-14 percent. It states that the rise in food basic agricultural products will continue due to the rise in exchange rates, oil and commodity prices. As the report increases its oil price forecast from $65 US dollars to $73, and inflation in food from 7 percent to 13 for 2018.

PINK PICTURE IN EXPORTATION

The report seems to revise the previous report in April, showing a downward in terms of funding and market possibilities because of international developments. As the decline in growth forecasts for the advanced capitalist countries except for the U.S. leads to a downward in exportation expectations, the report underlines that the rise in the U.S.-based investment instruments increases doubts in terms of developing countries.

The report seems to disregard the loss of market in some sectors maintaining exports such as automotive, showing that the report appears to be optimistic about current deficit forecasts particularly since the rise in borrowing costs is not adequately reflected upon inflation expectations.

‘MARKETISM’ IN STRUCTURAL ISSUES

A chapter on “structural issues” ironically reveals the extremely pro-market approach of the capitalist government of Turkey. As the report points out to insufficient planning and abundance in mediators as the basic problems leading to challenges in supplies regarding the inflation in agricultural products and food, it also indicates to the “malfunctions in the market”. Without dwelling on the role of food and retail monopolies in the process, the report projects to improve “planning”, distribution and storage of goods with a further pro-market tendency.

Yet another topic in the report suggests that “project-based promotion investments” that was announced in previous months will decrease the importation dependency, particularly on chemical and plastic goods. The report alleges that the investments that will take place as early as 2020 will largely decrease the current deficit.

As the report states that the net importation of promote products reaches up to 17 billion U.S. dollars, it does not reveal the capacity formed for investments, let alone showing how much of that 17-billion-dollar would be generated through these investments.