Changing balances and fragilities in the world economy

The world economy went through two big crises before the end of the first quarter of 21stcentury. How did the balance of power between countries and economic relations change? A veteran Marxist economist and soL columnist, professor Korkut Boratav answers this question focusing on the last ten years, starting from the onset of the recent crisis. An important dimension of the issue can be analysed by looking at world current account balances which show the trade and income flow among big countries and major trading blocks.

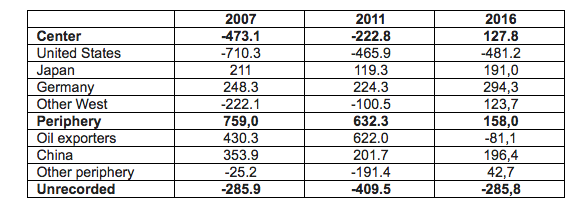

Boratav shows the world current account balances on the following table using IMF statistics with a slight change in IMF country classifications. He lists four East Asian countries (South Korea, Taiwan, Singapore, Hong Kong) under “other periphery” instead of "centre".

Principally, total current account deficits (negative numbers) and current account surpluses (positive numbers) should be equal, and the sum should be zero. However, because of the "dark and mysterious" areas of the world economy and the deficiencies in the IMF records, we see astronomic numbers of "unrecorded flows" every year. Boratav summarises the economic developments of last decade using this table.

World Current Account Balances (billion dollars)

2007 was the onset of the global economic crisis.

The recession that was going to start in the of 2007 was not reflected in the statistics yet. Finance capital became wild, and the bubble was about to burst. Consumption was exceeding the production in the U.S with a resulting current account deficit of 710 billion dollars. Japan, oil exporting countries and China were financing the US current account deficit. How? By putting money in the stocks in New York Stock Exchange, US bonds, real estate in New York and Florida… Boratav explains. Europe had a similar situation. Germany was financing the current account deficits of the weakest EU countries (“other west”) creating the preconditions of the crisis that was going to burst out in four years in Euro area.

Majority of the other periphery countries especially East Asia were having current account surpluses. Meanwhile, Latin American countries such as Mexico, Eastern Europe and Turkey were running current account deficits. Turkey’s deficit was reaching to 5.5 percent of GDP with 37 billion dollars. The countries which were going to hit hardest by the global crisis were those running deficits.

The through of the recession was over in the U.S. in 2011; The Euro area was still in crisis.

Stagnation and shrinking in the US economy reduced its current account deficit by one-third. Germany forced the five poor countries of Euro region ("other west") to apply austerity policies. With the austerity policies, these economies shrank, and their current account deficits were reduced.

On the other hand, periphery economies were flush with liquidity aided by monetary stimulus from western central banks and lower exchange rate encouraged trade deficits. As a result, the big periphery countries except from China and East Asia had large current account deficits. Turkey had a current account deficit over 74 billion dollars (about 9 percent of the GDP) in that year.

Oil exporters’ current account surpluses reached to record high levels. The contribution of oil exporters to the financing of global account deficits exceeded the total contributions of China, Germany and Japan.

The striking change in 2016 was current account deficits of oil exporters

50 percent reduction in crude oil prices in 2015 affected the world economy in 2016.

The result was the elimination of the current account deficits in "other west" and "other periphery". Turkey kept running the deficit but saw improvements in the size of the deficit until 2017.

The drop in the price of oil did not lead to a revival in the world economy. On the contrary, the average growth rates in centre and periphery were falling in 2014-2016. Oil exporters reduced the investment funds, focused on the domestic economy and cut the imports thereby slow downed the world economy.

WHICH COUNTRIES ARE AT THE TOP OF THE IMPERIALIST SYSTEM?

Boratav asks the question whether "a country running high chronic current account deficits like the U.S. could stay as the dominant power of the world economy."

He looks at the international investment positions of countries using data from a 2016 report released by McKinsey Global Institute (The New Dynamics of Financial Globalization, August 2017). Net international investment position (NIIP) of countries is calculated as the difference between a country’s stock of foreign assets and its foreign liabilities. Boratav uses this variable as a measure of countries’ positions in the imperial system, dominant or dependent. For example, China has 6.6 trillion worth of foreign assets and 4.7 trillion worth of liabilities. Its net international investment position is a surplus of 1.9 trillion dollars. The U.S., on the other hand, has a net deficit position worth of 8.3 trillion dollars.

According to McKinsey report, the old imperial powers such as Germany, Japan and the United Kingdom are the net investment surplus countries. China is in the same situation, therefore in the same camp.

The dominant powers of the imperialist system are determined by state policies, military force and economic measures discussed in this article. Boratav argues that according to economic measures, the U.S. lost its hegemonic position but is not aware of it. China, on the other hand, is settling into the top of the world system.

FRAGILITIES IN THE FINANCIAL SYSTEM

If we look at the current situation, the warnings are becoming more frequent: when will the financial euphoria end? Is a harsh collapse probable?

Boratav refers to the Nobel winner economist Robert Shiller’s analysis of financial cycles and mentions his prediction. According to Shiller, the critical threshold for the downturn in financial markets is reached. The “bear market” is coming which is a market in which prices are falling, encouraging further sales. The bear market happens when stocks decline at least 20 percent from their peaks.

Turkey experienced the downturn of the financial cycle in 2015 with a shrinking of capital inflows by 29 percent. The revival in 2016 erupted with July shock with the coup attempt. The speedup in the capital inflows started in 2017 continues so far but until when?

FED's and OTHER CENTRAL BANKS' ADDITIONAL FEATS

Western central banks are contributing to the fragilities with expansionary monetary policies. Financial markets are flooded with liquidity and banks could borrow with close to zero interest rates… A fantastic situation for the finance capital… Excess liquidity flowed to the periphery economies and increased carry trade.

FED stopped injecting money to the system by buying stocks and bonds from the market in 2015. The bonds bought during the quantitative easing (money printing) period were kept in the balance sheet. They carry different maturity dates. When the bonds reach maturity, FED was reinvesting and rolling over the bonds. FED took a new decision last week, Boratav explains, they are going to start unloading the balance sheet gradually starting from 10 billion dollars’ worth of bonds monthly. This means a financial contraction of 50 million dollars monthly during this year. One outcome of this policy is capital outflows from the periphery.

"My humble suggestion to Turkey is to enjoy the economic boom created by hot money flows now because it seems like it won’t last long. If Shiller is right, the downturn that will start in 2018-2019 will affect us as well. Turkey will go through a difficult two years as a stable member of the 'fragile emerging market economies' list" Boratav adds.